Strategy Master List - a list of all of our current Strategies

| Strategy Name | Universe of Stocks Traded | Strategy Category | Average Annual Return % (CAR) | Risk Adjusted Return % | Maximum Drawdown | Link to Daily Strategy Signals | Link to Historical Backtest Results | Access Level Required |

|---|---|---|---|---|---|---|---|---|

| (as of Apr 9 2021) | (as of Apr 9 2021) | (since Jan 1, 2000) | ||||||

| RSI-2 Pullback | Nasdaq 100 | 1. RTM | 14.32% | 25.65% | -35.95% | Click Here | Click Here | Free Member |

| High-Five Bounce | S&P 1500 | 1. RTM and 4. Volatility | 11.10% | 15.67% | -17.53% | Click Here | Click Here | Portfolio Trader, Strategy Developer |

| Narrow Pullback | S&P 1500 | 1. RTM | 11.97% | 19.80% | -14.20% | Click Here | Click Here | Portfolio Trader, Strategy Developer |

| Narrow Pullback | S&P 500 | 1. RTM | 19.28% | 26.34% | -17.51% | Click Here | Click Here | Portfolio Trader, Strategy Developer |

| NDX Momentum | Nasdaq 100 | 1. RTM and 2. Momentum | 37.01% | -22.90% | Click Here | Click Here | Mountain Trading | |

| NDX Rotation | Nasdaq 100 | 1. RTM and 2. Momentum | 34.65% | -31.86% | Click Here | Click Here | Mountain Trading | |

| Super-Charged Momentum Trend | S&P 1500 | 2. Momentum and 3. Trend Following | 14.90% | 21.11% | -16.34% | Click Here | Click Here | Portfolio Trader, Strategy Developer |

| Fab Tech Rotation | Nasdaq 100 | 2. Momentum (Monthly Momentum Rotation) | 22.06% | 35.00% | -31.96% | Click Here | Click Here | Portfolio Trader, Strategy Developer |

| Squeeze Pause Sprint | S&P 1500 | 4. Volatility | 13.60% | 18.39% | -13.57% | Click Here | Click Here | Portfolio Trader, Strategy Developer |

| Squeeze Pause Sprint | Russell 3000 | 4. Volatility | 16.10% | 20.83% | -16.70% | Click Here | Click Here | Portfolio Trader, Strategy Developer |

| Squeeze Break-out | S&P 1500 | 4. Volatility | 12.91% | 16.62% | -25% | Click Here | Click Here | Portfolio Trader, Strategy Developer |

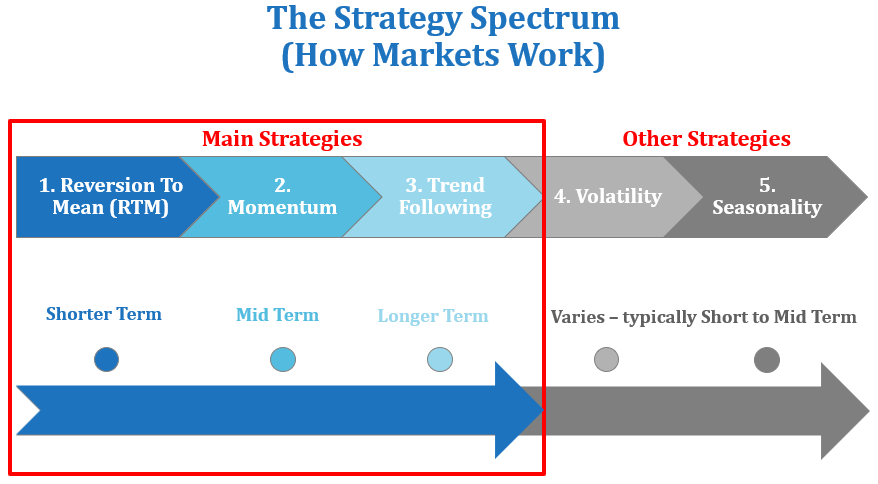

A robust trading plan benefits from the diverse characteristics of how markets work.

Here’s a visual that shows different characteristics and types of Strategies that can be used to balance out a Systematic Investor's entire portfolio.

Starting with the three (3) Main Strategy Types, from left to right…

- Reversion To Mean (RTM). A shorter term strategy that exploits the fact that markets pull back before they move higher. The FREE RSI-2 Strategy fits this criteria.

- Momentum. A mid-term strategy that exploits the well documented momentum phenomenon of the market (a stock in motion tends to stay in motion, until it doesn't). For example, a monthly momentum rotation strategy. Or, other type of short to mid-term momentum strategy.

- Trend Following. A longer-term strategy that capitalizes on the momentum phenomenon further and the fact that markets trend over long periods of time, typically in the longer-term Trend Following category. (The FREE Super-Charged Momentum Trend Strategy fits somewhere in the middle within the 2nd and 3rd categories. It is both a shorter to mid-term momentum, as well as a mid-term trend following approach.)

- Volatility. Strategies that are based on volatility instruments, or, based on underlying volatility measurements or algorithms and base their trading decisions on same.

- Seasonality. Strategies that exploit the well-documented seasonal tendencies of some markets, driven by cyclical behavioural patterns or "calendar" specific events based on fundamentals or other factors that are recurring -- and, provide specific opportunity windows of time to trade with a positive edge.

* SPY Benchmark. If you want to see how owning the SPY (ETF) since January 1st 2000 has performed, you can link to that backtest by clicking here.