The Effect of Commissions and How Much to Get Started Trading With?

Getting STARTED with anything new is always hardest. The amount of friction points to overcome are always the strongest... there are always so many questions to answer first!

How Much $$$$ Do I Need In Order To Get Started With Systematic Investing?

This is a common question, and for good reason. The answer is going to be different for every Trader or Investor, but let's try to wrap some logic around this question.

When someone asks how much they need to get started, they usually are thinking about how much money they will need in order to see some type of reasonable return, and, are concerned that the amount of commissions generated, especially on an active strategy, might eat into their returns so much that the only one making money will be their broker. In other words, what is the right balance between amount of starting capital and return, taking into account commission drag? This is totally valid.

The answer will be different for everyone, but hopefully we can generalize or provide some rule of thumb here.

It is our opinion that when getting started with Systematic Investing (Trading), you should have at least 10,000 US dollars. The reason is that most of the trading that we do is portfolio-based trading of stocks with 5-20 individual stock positions in the portfolio in order to diversify opportunities, spread risk, and lower draw downs caused by any one (1) position that may "go rogue", or for example, have a "gap down" due to a news or earnings event.

More realistically, after paper testing a Strategy that you are interested in, you'll probably want to start to trade with at least 20K per Strategy and then increase that amount per Strategy as warranted, so that commission drag on each Strategy isn't too high.

An ideal starting point would be around 50K US Funds for 1-2 Strategies, and better yet, about 100K for 1-3 Strategies. You could then increase your sizing based on accumulated returns - effectively, compounding. Additionally, you could add regular contributions to your trading account(s) from other earnings sources so that you build your accounts up over time. This is a good method, similar to how you might make regular contributions to a registered retirement savings plan.

Of course, this is all at the discretion of each individual and should take into consideration both your investment and life goals, and, it's a good idea to review it with a registered financial planner.

How Do Commissions Affect Strategy Starting Equity?

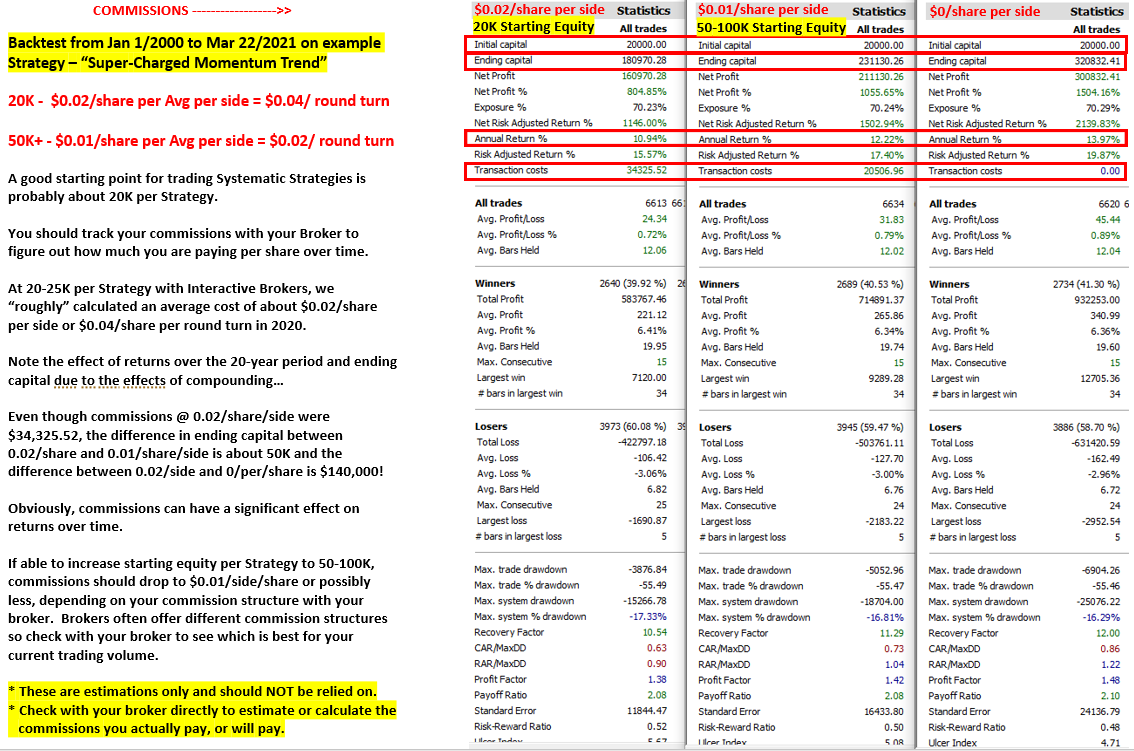

At Systematic Investors Group, we performed a high-level, basic analysis of this question by looking at one of the FREE Strategies that we offer, the Super-Charged Momentum Trend Strategy. We chose this Strategy because it's quite active and will generate a relatively high amount of commissions compared to less active Strategies. A "worse-case scenario", if you will.

We looked at commissions starting from Jan 1 2000 until Mar 22 2021.

(The actual commission rate chosen came from a separate internal analysis that is not shown here, that looked at a report of trading commissions for a real live trading account that was trading approximately 15-25K in each of the Super-Charged Momentum Trend and the RSI-2 Free Strategies during 2020).

The analysis of these commissions paid showed costs of around $0.021 per share per side (average) using Interactive Brokers, or $0.041 per share per round turn (ie. from opening trade to closing trade).

The commissions were relatively high and represented about 27% of the total profits during the report period!

Considering these are quite active strategies, it's not uncommon for commissions to be on the high side, however, we believe that commissions for these most active End Of Day (EOD) Strategies should probably represent closer to 10% or less of total profits.

As you increase your account size and allocation per strategy and each position size grows as a result, commissions will naturally become lower per share. An ideal goal would be 0.005-0.01 per share per side, perhaps even less.

As your trading volume increases, you should analyze your commission costs and even negotiate with your broker for lower commissions where possible once you can show a track record of trading volume.

What about free commissions? There has been a lot of talk about commission-free brokerages lately. The fact of the matter is, you ALWAYS pay commissions, whether you know it or not. If you aren't paying commissions directly, then the broker is typically selling all of it's customer's order flow to a high-frequency trading firm, in which case you are indirectly paying commissions through front running, order sniffing and slippage to these "new market makers". You are likely better off paying for the commissions up front to your broker, instead of through the "back door" with some broker's new practices of selling order flow to firms like Citadel.

Have a look at the below basic analysis. Hopefully this will all make more sense as you analyze and compare some of the numbers.

(Backtest is based on the Super-Charged Momentum Trend Strategy)

Notes:

- Each column shows starting capital at 20K, however, we reduced the commissions to about what you might pay if you were starting with 50-100K in capital in the middle column, in order to compare what would happen if you reduced the commission rate per share.

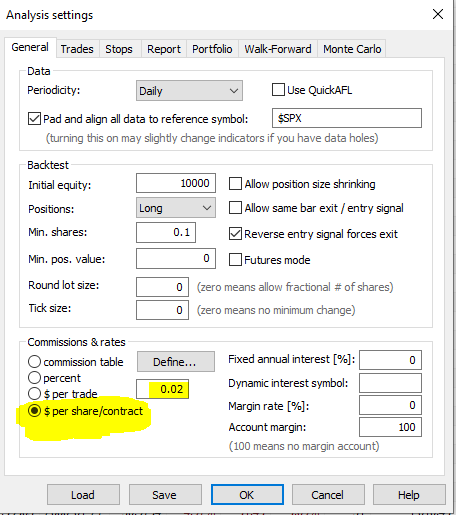

- In reality, the commissions would adjust (similar to a sliding scale) over time as equity grows, so that the commission amount per share would be lower per share (as equity were to increase). We did not use the commission table feature in AmiBroker when running this analysis, we simply used the below settings...

- Note that the AmiBroker setting (below) of $0.02 on a $ per share/contract represents $0.02 per share per side. In the backtest result this equals $0.04 per share per round turn (from opening to closing trade).

Good Systematic Trading & Investing,

Dave

Systematic Investors Group Team